The Ultimate Cheat Sheet on the Swedish Food Retail Landscape

Scandinavia has long been THE place to prosper for health and wellness brands. The Nordic countries are a fertile region for natural and organic product exporters. The market provides opportunities for British wellness food producers to gain new customers abroad. Take a look at our findings about the Swedish food and drink landscape!

So what’s going on in Sweden at the moment?

Contrary to us thinking Swedes are the European leaders in healthy living, Sweden has a conflicting relationship with food. The number of fast food outlets is increasing consistently, but so is the amount of healthier meal options in fast food menus.

Organic and health conscious grocery store chains such as Goodstore, Paradiset, andEat! Ekoaffären are the key retail leaders and popping up all over the place. Euromonitor’s research “Fast food in Sweden” reports that fast food is undergoing a premiumisation trend with fast expansion of healthier food options, especially the gourmet options.

Swedes are very eager to introduce healthier food and drink choices into their diet. At the beginning of April, McDonalds introduced the first vegan burgers on their Swedish menus.

Axfood is one of the three biggest grocery food chains in Sweden and a leader in packaged food sales. The other two main players are Coop Sverige AB and ICA Sverige AB. Axfood is known for offering consumers a range of private label especially in the packaged food segment, including organic and fair trade items. When it comes to healthier decisions, Swedes show a growing preference for online shopping on platforms such as Holland & Barrett.

There has been a positive increase in online sales – more and more webshops like online chemists and pharmacies are gaining customers because of the wellness trends. Interest in health and wellness has generated sales in sports nutrition, preventive self-medication, vitamins and dietary supplements.

Which Categories are Booming?

Can you join the fika break?

Snacking constitutes a part of the Swedish culture.Working people have a snacking break called ‘fika break’ to socialize, drink coffee and consume a snack. Surprisingly, the healthier Swedes get, the more they feel the need to indulge in treating themselves with packaged snacks. Therefore organic snacks, protein ice cream or for example low sugar chocolate bar sales are increasing at record pace, including UK brands, such as Deliciously Ella which can be found in Starbucks coffee shops and health food stores. Swedes have an appetite for international products.

Snacking constitutes a part of the Swedish culture.Working people have a snacking break called ‘fika break’ to socialize, drink coffee and consume a snack. Surprisingly, the healthier Swedes get, the more they feel the need to indulge in treating themselves with packaged snacks. Therefore organic snacks, protein ice cream or for example low sugar chocolate bar sales are increasing at record pace, including UK brands, such as Deliciously Ella which can be found in Starbucks coffee shops and health food stores. Swedes have an appetite for international products.

Despite perhaps our stereotypes of Swedes being super healthy and fit quite surprisingly and according to the World Health Organization one fifth of the Swedish population is obese, making health a great concern and health foods very marketable.

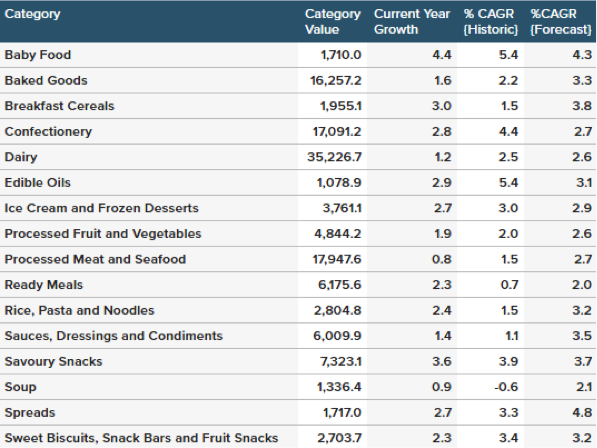

The current retail value of packaged food is 10.33 GBP million and is estimated to reach 12 GBP million by 2022 and as shown in the table, all packaged food categories are forecast to grow by 3,15%.

At Bolst Global we believe that Sweden is an attractive market for innovative health and wellness products, especially food and drink segment. Our internationally experienced and knowledgeable team work in the Swedish market and can help you understand and penetrate the market. If you would like export management support for the Swedish market, please complete the contact form below and one of our team will be in touch with you shortly.